From the past few years, copy trading has been growing, and it is certainly a good solution for when you need some help in your trading. The better the indication you get, the more successful you may be and it also provides a great learning opportunity for novices.

Copy-trading generally allows to automatically copy the positions opened and managed by a selected investor, and this is normally carried out through a social network.

Copy-trading is frequently referred to as social or mirror trading and is substantially a way for traders to mechanize their trading by copying the trades of other people. The majority of the time, copy trading is used by beginners as they do not have proper knowledge of how to seal a successful trade. In that case, all they have to do is to find a winning trader and start copy trade their trading signals. Once they gained enough understanding and skill to make their trades, they will no longer have to get insight from other people.

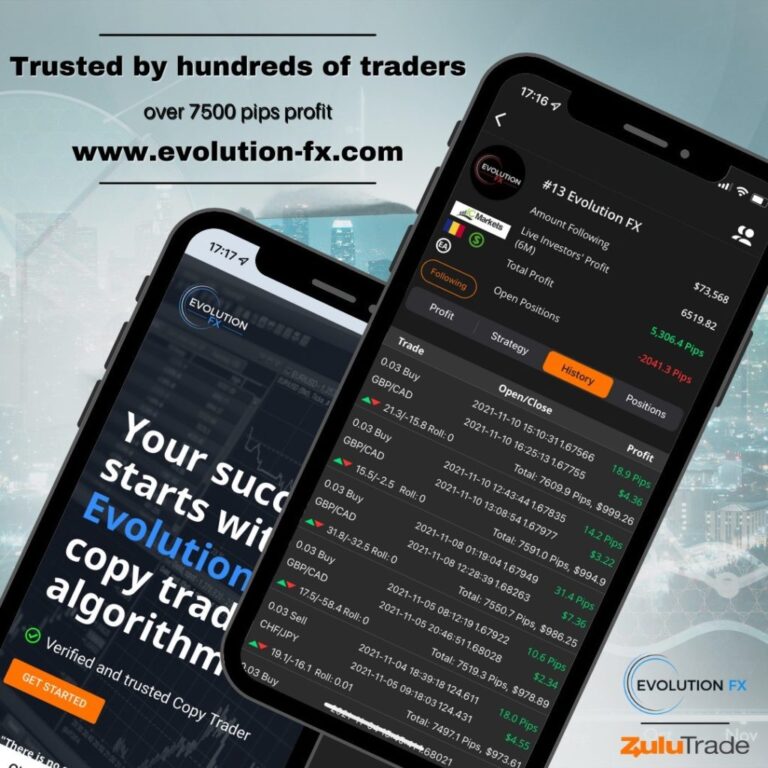

As a pro copy trader you can find traders that have done all of the work for you and have verified they are making regular profits, and then just copy their trades to make profits.

The vital thing being a copy trader is that you are not giving anyone your money, you are just copying the trades of proven traders you are following.

Should You Learn to Trade and Invest With a Professional?

Using a service let you find traders who have a track record of making profits and then copy/follow their trades using part of your capital.

You can also select many distinct traders you want to follow and split your capital so that your risk is split and not just on anyone trader.

It allows you to become your hedge fund manager, assigning portions of your capital where you see fit to make the very best returns for your capital.

You can have a wide range of options to filter down the traders you want to follow, from their trade frequency, amount of profitable trades, what markets they trade and their draw-downs.

Being able to take the time to learn to trade appropriately, at the same time as making returns is probably the ultimate win for a trader.

Taking this method and using the hedge fund analogy; you can assign part of your capital to copying traders who have a proven track record of success and part of your trading cash to yourself to help you learn to trade in the markets.

You can also get a chance to master your trading strategies on a practice demo account even giving yourself the time you require to become ready to assign yourself more money.

Copy trading is used by beginners and experts alike, as it can not only give the trader a enhance, but it may also increase their profitability with barely any effort. Copy-trading offers an interesting and wiiide open way to trading and is now readily accessible with immense developments in social trade and the numerous social trading networks