Become a PRO

BlackBull Markets Review

BlackBull Markets Overview

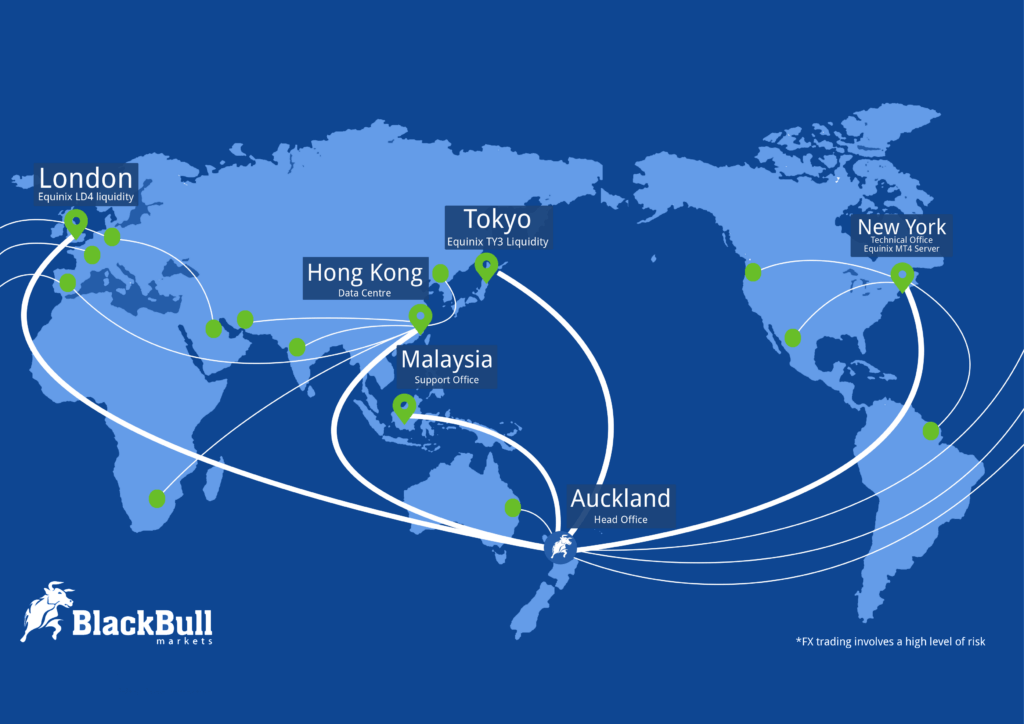

Black Bull Group Limited (BlackBull Markets), was established in 2014 and has its headquarters in Auckland, New Zealand. It also maintains a support office in Kuala Lumpur, Malaysia.

The company has a combined total of ten years of institutional expertise in the foreign exchange market. In addition to delivering institutional-grade fintech services to retail clients, the broker is a real ECN brokerage with No Dealing Desk.

Deep liquidity, institution-level pricing, and large leverage are three characteristics that each successful trader looks for in ECN/NDD trading conditions. Fortunately, BlackBull Markets provides all three, and the most important is the core technology that allows them to do so. It provides high-speed trading while also providing scalpers and other high-frequency traders with the precise tools that they require to succeed.

Traders get access to great platforms as well as extra applications such as Myfxbook and ZuluTrade, among others. Institutional clients can also benefit from premium services and PAMM accounts.

Is BlackBull a properly licensed and regulated broker?

There are two well-regulated subsidiaries available to BlackBull Markets clients:

- New Zealand Financial Markets Authority (FMA)

- Seychelles Financial Services Authority (FSA) for the BBG Limited subsidiary

All client deposits are kept separate from corporate resources, and the trustee bank is the Australian and New Zealand Banking Group (ANZ Bank).

The BlackBull Markets Group is registered with the Financial Services Providers Registry of New Zealand (FSPR). Aside from that, BlackBull Markets is a signatory in the Financial Services Complaints Limited (FSCL) dispute resolution mechanism in New Zealand.

The FSPR’s goal is to improve transparency, give corporate information, and assist organizations in meeting their international AML/CFT compliance responsibilities. All businesses that are registered with the Financial Services and Markets Authority (FSMA) must also be members of an impartial dispute resolution system. This is done in order to ensure that complaints are handled in an impartial and independent fashion.

BlackBull Markets have severe regulations in place for anti-money laundering (AML) and counter-terrorist financing (CFT) activities. This is done in order to guarantee that business practices are conducted in an ethical and transparent manner. As part of their ongoing commitment to upholding the highest levels of conduct and operational standards, a very well supervision system has been put in place with the goal of constantly protecting traders.

What Are The Fees And The Commissions?

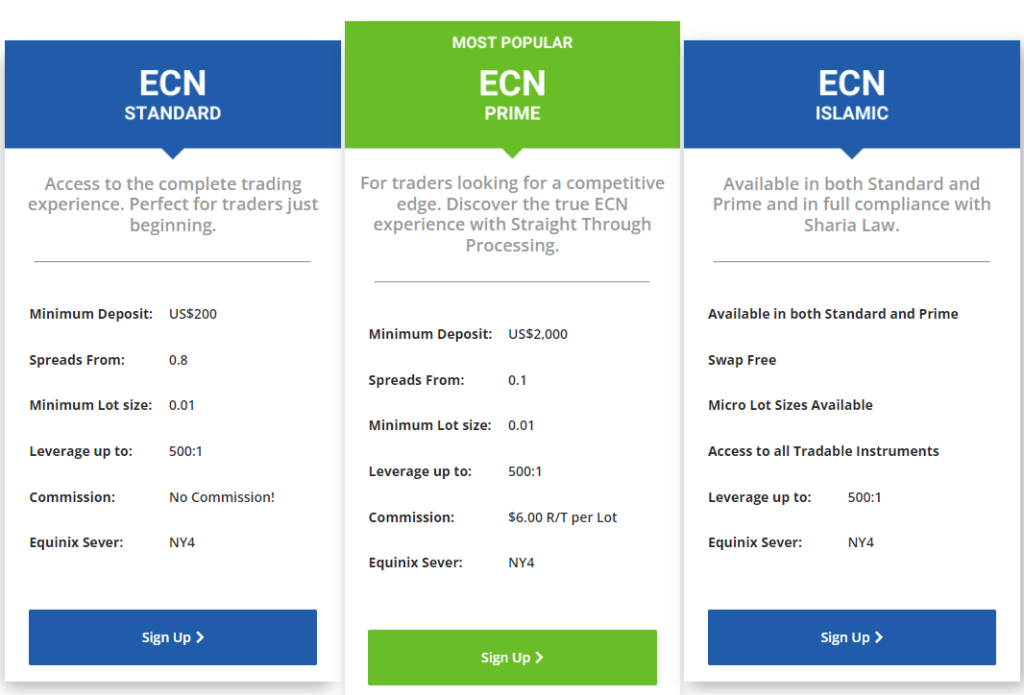

BlackBull Markets offers a variety of trading accounts that may be customized to meet the needs of individual traders. A minimum lot size of 0.01 is expected for all accounts, as is maximum leverage of 1:500, and access to all trading instruments. For those who would want to experiment with different trading platforms and settings before committing to an actual account, demo accounts are accessible to use.

With an average raw spread of only 0.1 pip during the London/New York overlap, BlackBull is offering a very low spread and an outstanding offer to its customers.

High-volume traders who use the Active Trader Account may be qualified for rebates as well as more personalized offers from the broker. Accounts that are Islamic-friendly and in compliance with Sharia law are accessible.

What type of accounts do they offer?

- ECN Standard – Equinix NY4 is the server where the account is hosted, and a $200 minimum deposit is required to open the account. Spreads begin at 0.8 pips, and there are no commissions charged on this account.

- ECN Prime – The account needs a minimum deposit of $2,000 and is hosted on the Equinix NY4/LD4/TY3 servers, which are available for purchase. Starting at 0.1 pip, spreads are competitively priced, and there is a reasonable $3 commission charge.

- ECN Institutional – The account needs a minimum investment of $20,000 and offers a variety of server configurations that may be customized. Spreads start as low as 0.0 pips, and commissions are flexible depending on the broker. Generally speaking, the greater your trading volume, the better the commission rate you will be able to secure.

What Assets Can You Trade?

When it comes to assets, BlackBull Markets offers a diverse selection of markets. These include more than 64 main and minor currency pairs, indexes from major stock markets, precious metals like gold and silver, and commodities such as energy, gas, and oil. Investors can trade from the opening of the market on Monday until the closing of the market on Friday, 24 hours a day, five days a week. Because of the variances in time zones, the particular opening hours of brokers vary from one country to the next.

BlackBull Markets Leverage Options

In addition to forex trading, BlackBull Markets now provides gold and silver trading with a maximum leverage of 1:500. The ratio of indices to oil remains at 1:100. There is a three-tier system in place, with the lowest tier being 1:200 above 0.50 lots and the highest tier being 1:100 above 1 lot.

What are the supported trading platforms?

BlackBull Markets provides traders with the industry-standard MT4 and MT5 trading platforms. Although MT4 continues to be the market leader in algorithmic trading, both MT4 and MT5 have support for it. Trading platforms have a copy-trading feature as standard functionality. BlackBull Markets provides MT4 as a desktop client, webtrader, and mobile app, however it appears that MT5 is only available as a desktop client. In addition, Virtual Private Servers (VPS) and FIX API Trading are both offered.

Metatrader 4

The BlackBull Markets MT4 is connected to the NY4 Equinix server, which is located on Wall Street and has a response time of 2-5 milliseconds, allowing it to process trades quickly. Using this server, you will be able to trade the markets directly with a large number of liquidity providers who will give you with the best bid/ask prices available, with less slippage and smaller spreads.

What Sets BlackBull Apart From Other Brokers?

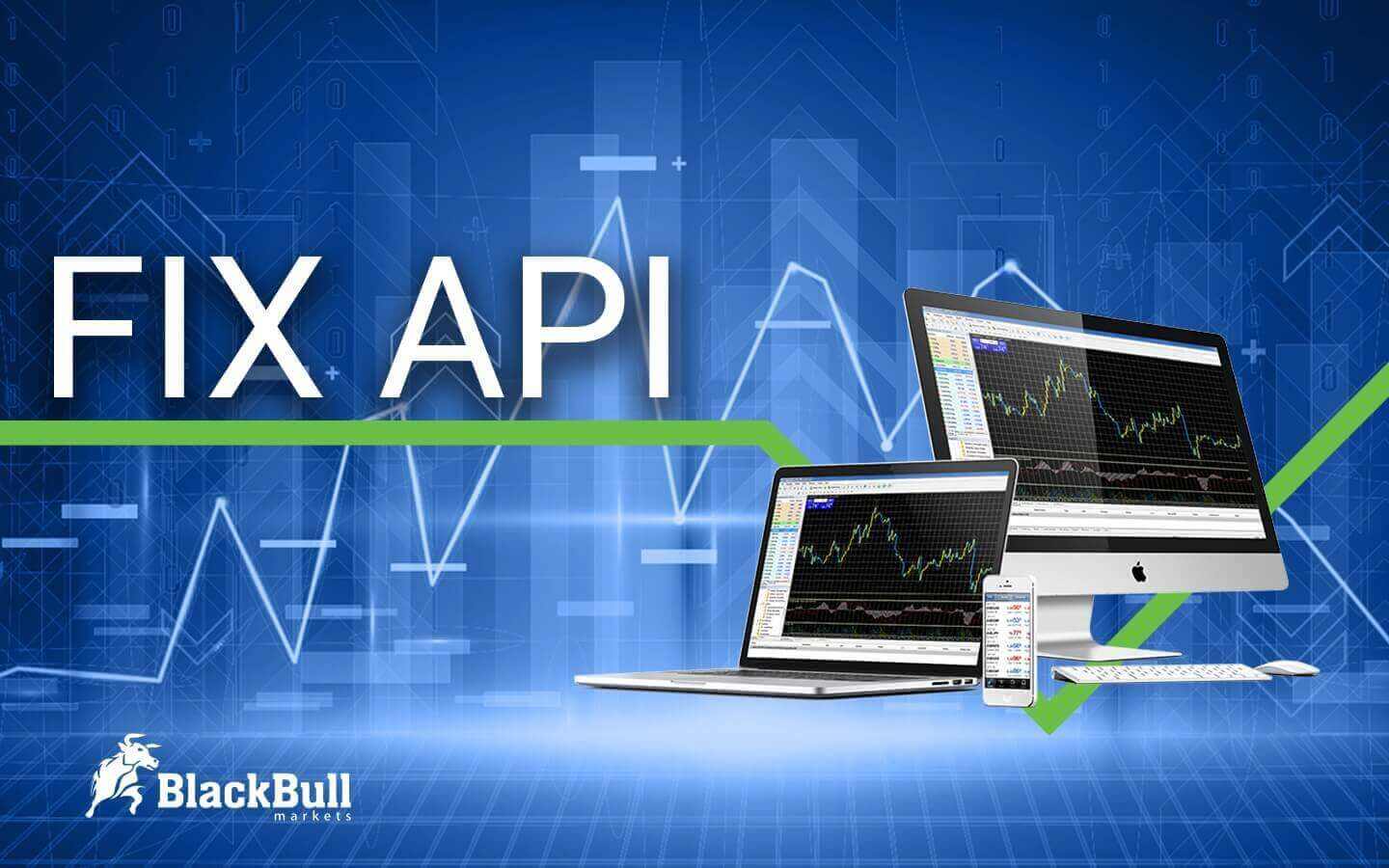

BlackBull Markets provides the FIX API, which enables algorithmic traders to link innovative trading tools to the trading platform. VPS hosting from NYC Servers or BeeksFX is provided for free for ECN Prime accounts with a trading volume of more than 20 lots per day.

Virtual Private Servers

BlackBull Markets can offer Virtual Private Server (VPS) hosting that is connected to the Equinix Servers by fiber optic cable, allowing traders to use the MT4 platform remotely without requiring to have the PC turned on. A virtual private server (VPS) may be configured to meet traders’ specific needs and minimize latency by up to 30%. When running an expert advisor, they are frequently utilized by traders who cannot afford any downtime (99.99 percent uptime) or who want the trading platform to be available at all times (24/7, generally) (EA).

FIX API Trading

Customers that prefer to deploy their own FIX application can do so by accessing the FIX API provided by BlackBull Markets. This enables the user to trade with Direct Market Access (DMA), which connects it directly to the ECN grid, rather than through the MT4 program. DMA has the potential to boost transaction speeds while simultaneously decreasing latency. Clients with institutional accounts can take use of FIX API trading solutions.

Copy/Social Trading

BlackBull Markets also offers social trading through partnerships with industry leaders ZuluTrade and Myfxbook Autotrade. The Prime Liquidity service, which is available to institutional clients, helps them to confirm their liquidity.

MAM / PAMM Accounts

Multi-Account Manager (MAM) and PAMM (Percentage Allocation Management Module) options are available from BlackBull Markets for investment managers who need to execute bulk orders from a single master account to several additional accounts.

Does BlackBull Offer Education and Free Research Solutions?

In addition to a few basic films covering subjects such as how to manage the trading account and how to do chart analysis, BlackBull Markets also has a training video section. Under the market reviews area, the broker also gives some valuable trading advice, as well as many market review articles each week that are relevant to traders.

How efficient is Customer Support?

BlackBull Markets provides detailed answers to some frequently asked questions in its FAQ area, as well as thorough descriptions of its goods and services. As a result, most investors will not seek help until there is a real emergency situation. A customer support agent will be on hand in such an instance, thanks to the efforts of BlackBull Markets.

Customer service is available 24 hours a day, seven days a week by online chat, telephone, and email. BlackBull Markets strives for a response time of no more than 24 hours. They have representatives in each major market to provide help and answers to general and technical concerns, and they have global offices to do so. Clients are also assigned personal account managers who are available to help them whenever necessary.

How To Sign Up For A BlackBull Markets Trading Account?

Registration for a BlackBull Markets account is a simple and quick procedure that can be completed online. You only need to fill up a little form on the website and confirm your email address. After that, you’ll need to upload your identification and address papers for use in the Know Your Customer (KYC) process. Once your application has been granted, you may fund your account and begin trading.

Deposits And Withdrawals

Users may fund their accounts and withdraw funds using a variety of methods that are tailored to every need. These include bank wire transfers, credit/debit card transactions, and online payment processors such as Skrill, fasapay, and Neteller. Some options will be quicker and more accessible than others, depending on the situation.

When selecting certain payment methods, you may be subject to additional costs. It may take a few business days for bank transfers to be processed. Accounts can be opened in any of the following currencies: AUD, USD, EUR, GBP, CHF, JPY, NZD, CAD, SGD, HKD. Exchange rate fees are not charged while using a bank account in your home currency, which makes the numerous currency possibilities a valuable asset.

In addition to the first minimum deposit ($200, $2000 or $20 000, depending on the account type), BlackBull allows traders to deposit any amount they like after that.

BlackBull Markets handles all withdrawal requests within 24 hours, and the back office manages all financial operations through an intuitive interface that is easy to use. There is a $5 charge for withdrawals.

Using payment processors, it is not possible to withdraw more than the amount of the deposit made thus far. Traders are required to make such withdrawals directly to their bank accounts.

Is BlackBull Markets The Right Broker For You?

BlackBull Markets is growing at a quick rate, and the company has received several honors in the process. Extreme care is taken to provide superior trading conditions, including low spreads, high execution speeds, and affordable costs.

Regardless of their level of experience or the magnitude of their investment, BlackBull Markets treats all of its clients as if they were institutional clients. It is their ongoing goal to improve and advance their brokerage service for the benefit of their clients and customers.

The platforms and technologies used by BlackBull Markets are among the finest in the business, and they are in place to ensure that customers can maintain and increase their competitive advantage in the global markets.

Pros

- Commission free accounts

- Tight spreads & fast execution speeds

- Electronic Communication Network (ECN)

- Global Equinix servers

- Excellent customer support

- ZuluTrade and Myfxbook

- FIX API trading

Cons

- Cryptocurrencies not available

- No negative balance protection

- US clients not accepted

- No fixed spread accounts

THE NEXT GENERATION OF TRADING TOOLS

- ZuluTrade and MyFxBook social trading

- MetaTrader 4/5 – The world’s most popular trading platforms.

- WebTrader – A web based online trading platform for novice traders.

- VPS - connected to the Equinix Servers

- FIX API Trading - deploy your own FIX application

Trade with an Award-Winning Broker