Become a PRO

AvaTrade Review : The Right Broker For You?

AvaTrade Review

Finding a good broker is hard work. There are plenty of scams out there, and sometimes something that seems too good to be true really is just that. In this article, we will review AvaTrade so you can see if they are the right decision for your personal trading needs.”

The global spread of financial markets and increasing complexity is a menace to many traders. If you look for a legitimate broker that can offer access to an extensive list of trading types, as well as excellent customer service, you have found one in AvaTrade.

AvaTrade is a great place to copy trade, highly competitive for mobile, mostly in line with the industry average for pricing and research, with a large focus on investor education.

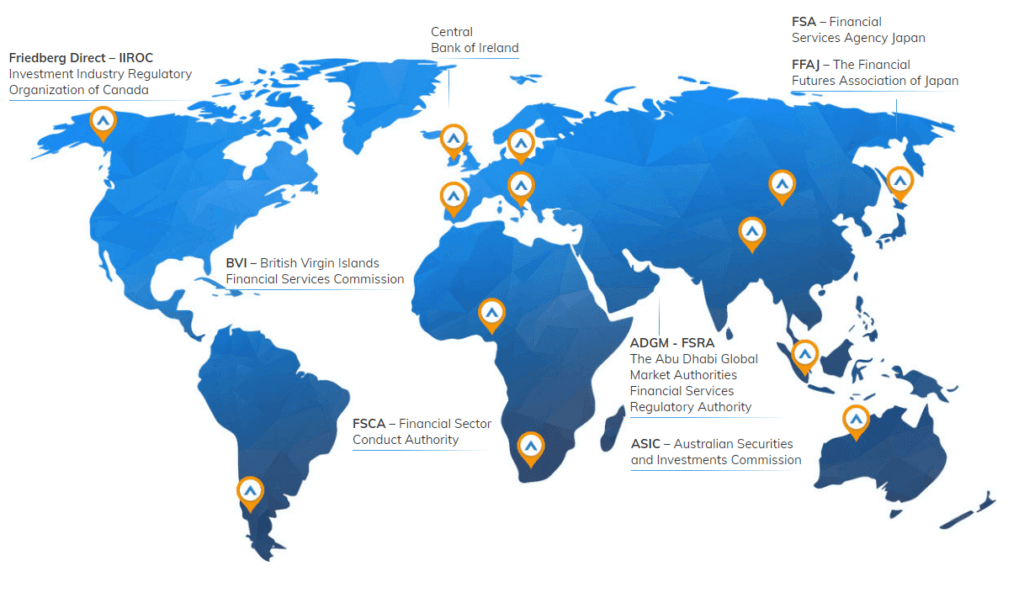

Is Avatrade a regulated broker?

AvaTrade is headquartered in Dublin, Ireland. They have offices throughout Europe and the Asia-pacific region and are registered with multiple jurisdictions globally (The British Virgin Islands, Australia, South Africa, Japan, United Arab Emirates, Israel).

Because the various regulators have different degrees of limitations, the trading conditions provided by these seven jurisdictions differ significantly. Although most new traders will find each regulatory structure to be fairly valid, dedicated, active traders who want increased maximum leverage may find the British Virgin Islands or South Africa to be the best choice.

AvaTrade’s regulatory structure is excellent, and it is one of the most respected in the business. AvaTrade keeps customer funds separate from corporation investments and protects against negative balances. A fund for investor compensation is also established in some countries.

Because AvaTrade is not regulated by the Financial Conduct Authority (FCA), it is exempt from ESMA’s customer account protection and leverage limitations.

AvaTrade, like many forex brokers, does not accept traders from the U.S.

What Are The Fees And The Commissions?

Every broker has two kind of fees: trading fees and non-trading fees:

- Trading fees appear when you trade. These can be commissions, spreads, financing rates and conversion fees.

- Non-trading fees are charges not directly related to trading, like withdrawal fees or inactivity fees

Trading Fees

AvaTrade provides traders with a commission-free platform, but at the cost of increased spreads. The EUR/USD trades at 0.9 pips every 1.0 standard lot, or $9.

Equity traders pay a 0.13% minimum spread, which is also commission-free. Depending on trading volume and period, some equity traders may be able to attain competitive pricing on specific assets. Traders of indexes and commodities benefit the most, as trading fees are among the lowest in the business.

When compared to its competitors, AvaTrade costs are average for all major currency pairs. AvaTrade’s forex commissions are completely transparent.

The broker offer a Trading Calculator that helps you to determine your next forex trade in 5 easy steps:

Non-Trading Fees

AvaTrade doesn’t charge any account fees, while deposits and withdrawals are also free of charge.

After three months of account inactivity, AvaTrade charges a $50 cost, and after a year of inactivity, it charges a $100 administrative fee.

- Enter the instrument you want to trade

- Set your account currency

- Select your preferred leverage

- Input the order type: buy or sell

- Select your trading platform

What Assets Can You Trade?

AvaTrade offers an asset selection suitable for all traders which consists of 55 currency pairs, 32 stock index CFDs, 625 stock CFDs, 59 ETF CFDs, 27 commodity CFDs, 2 bond CFDs, and 17 cryptos.

When Can You Trade?

AvaTrade’s trading hours depend on the asset class. You can trade cryptocurrencies 24/7, but the other assets are available only from Monday to Friday, when the international markets are open.

AvaTrade Leverage Options

The leverage option offered by AvaTrade depends on the regulatory jurisdictions. Retail traders get maximum leverage of 1:30, and the professional clients may qualify for a maximum leverage level of 1:400. That level can be obtained if your account is under British Virgin Islands or South Africa jurisdictions.

What Type Of Accounts Do They Offer?

AvaTrade provides all traders the same real trading account, with a minimum deposit of $100.

Also a demo account is available for a limited time of 21 days, but this period can be extended by request.

Does AvaTrade have a copy-trading option?

AvaTrade partners with ZuluTrade and DupliTrade to provide copy-trading. Both platforms allow you to replicate the actions of other traders.

ZuluTrade requires a $500 minimum deposit, while DupliTrade requires a $2,000 minimum deposit to begin trading.

AvaTrade also offers AvaSocial, a social trading smartphone app. AvaSocial allows you to follow and talk with other traders, as well as copy their trades. This service is provided in collaboration with FCA-regulated Pelican Trading, a third-party operator.

What are the supported trading platforms?

Desktop trading platforms

AvaTrade has a variety of trading platforms to choose from, including:

- WebTrader, AvaTrade’s own trading platform

- MetaTrader 4

- MetaTrader 5

- AvaOptions, AvaTrade’s own trading platform for CFD options

WebTrader Platform

Webtrader is a well-designed and user-friendly platform, even for inexperienced traders, but you cannot customise it by switching tabs and adding new ones.

Webtrader doesn’t offer the two-step authentication process for extra security.

You can use only basic order types: market, limit and stop.

AvaTrade offers easy-to-understand portfolio and fee information. They may be found in the ‘History’ section. You may also view the swaps charged if you click on your positions.

MetaTrader 4

Even if the Metatrader 4 platform feels outdated and sometimes it can be difficult to find some features, it’s very easy to customise. Like Webtrader, it only supports one-step authentication.

In addition to the basic order types (market, limit, stop), you can place order time limits such as “Good ‘till cancelled (GTC)” and “ Good ‘till time (GTT)”.

AvaOptions

AvaOptions is AvaTrade’s own intuitive and well-designed options platform. You can effortlessly choose the asset class and the trading method you want to use.

You can choose from a variety of option trading strategies and then customize all of the trade’s parameters using a straightforward graphical interface.

Mobile Trading Platforms

AvaTrade offers three mobile trading platforms:

- AvaTradeGo

- AvaOptions for mobile

- MetaTrader 4 mobile version.

AvaTradeGo mobile trading platform

This is AvaTrade’s own mobile trading platform, both available for Android and IOS users.

The AvaTrade mobile trading platform is intuitive and easy to use.

Aside from standard smartphone functionality like search and alarms, the app also includes educational videos and customer service chat.

AvaTrade FAQs

Does Avatrade offer education for inexperienced traders?

When it comes to education, AvaTrade stands out, and it shows that it cares about new traders. While the official website delivers content, SharpTrader provides the core service. The educational department of AvaTrade was launched with great success, and it remains one of the greatest overall tools for new traders in the business. SharpTrader has over 40 courses and 200 videos available.

How efficient is Customer Support?

AvaTrade’s FAQ page and chatbot provide the majority of customer support. Email and phone assistance are also available, and a multilingual customer support team is available throughout market hours. AvaTrade’s products and services are well-explained, and most of the time won’t need help. AvaTrade provides quick access to customer support 24/5 in the event that it is required.

AvaTrade offers an excellent live chat feature. There were no large lines to wait in. You may chat in a variety of languages, including Arabic, Chinese, French, Italian, German, and Russian, in addition to English.

The phone assistance provided by AvaTrade is satisfactory. You may discover a big list of local phone numbers for most countries on the website, avoiding the need to dial an international number.

How To Open An Account With Avatrade

Only an email address and a password are required to open an account with AvaTrade for international traders. Additional information may be required by some jurisdictions. Due to the fact that AvaTrade is a licensed broker, account verification is a required last step in the KYC process. Most traders will provide a copy of their ID and one proof of residency document to meet this requirement.

Minimum Deposit And Payment Methods

The minimum deposit at AvaTrade is $100 and can be placed by bank wires, credit/debit cards, Skrill, Neteller, and PayPal.

Although AvaTrade processes withdrawals within 24 hours, traders may have to wait up to 10 business days to collect their cash.

There are no withdrawal fees, but third-party commissions may occur depending on the used method.

What Sets Avatrade Apart From Other Brokers?

AvaTrade offers some unique features, such as the Trading Position Calculator. It’s a great risk management tool that also gives important trading data and helps traders to plan and manage their portfolios.

Another unique feature offered by AvaTrade is AvaProtect.It’s practically a hedge/insurance that you may purchase for a preset fee based on how long you want your trade to remain protected (1 hour, 1 day, etc.) AvaTrade will repay your losses if you lose money on that deal. This option is only available for market orders, not limit orders.

Is Avatrade The Right Broker For You?

AvaTrade’s trading ecosystem provides a variety of trading platforms as well as a sufficient number of assets to fulfill the needs of most investors and traders. It also supplies one of the greatest options for new traders, as well as a safe, secure, and transparent trading environment. Overall, AvaTrade is one of the most respected retail brokers on the market.

AvaTrade is worthy of appreciation. Depositor fees are competitive, particularly for those trading individual equities and shares bundled as CFDs. AvaTrade’s trading assets are extremely diversified, including Forex vanilla options and many ETFs, as well as a wide choice of individual stocks and shares, making it a better broker for traders looking for market diversity. AvaTrade’s reputation is at the top of the business, with a long track record and favorable regulatory status in the European Union, which is particularly outstanding, not to forget in Australia.

Pros

- Strong Regulations

- Excellent customer service and experience

- Strong education section with more than 50 video tutorials

- World's biggest copy trading platform

- Acess to ZuluTrade copy trading platform

Cons

- Bigger swaps than some competitors

THE NEXT GENERATION OF TRADING TOOLS

- AvaTradeGO – Connect to global markets easily with our award-winning mobile app that features live social trends.

- MetaTrader 4/5 – The world’s most popular trading platforms.

- WebTrader – A web based online trading platform for novice traders.WebTrader – A web based online trading platform for novice traders.

- AvaSocial – A social trading app that lets you copy top traders.

- AvaOptionsTM – An Options trading platform for smartphone and web with portfolio simulations.

Join over a million people