Become a PRO

FXCM Review

FXCM Overview

FXCM offers a wide selection of trading platforms and advanced trading tools, but high-interest rates, high trading costs, and currency conversion fees may be unsuitable for many traders.

FXCM offers an average number of financial instruments, including currencies, commodities, indices, share CFDs, and cryptocurrencies. FXCM’s single account has a minimum deposit of $50 and average spreads of 0.20 pips for the EUR/USD pair, which is wider than other brokers generally offer.

For traders whose monthly trading volume exceeds 10 million USD, FXCM offers discounts, dedicated customer support, free VPS services, and free access to multiple APIs.

Is FXCM A Properly Licensed And Regulated Broker?

Founded in 1999, FXCM is a global Forex and CFD broker with offices in major cities. FXCM is a financial services company based in London that is regulated by several leading authorities, including the FCA UK, ASIC Australia, CySEC Cyprus, BMA Bermuda, and FSCA South Africa.

The British branch of FXCM, the trading firm, and brokerage, will be trading under its subsidiary, FXCM LTD, which is regulated by the Financial Conduct Authority. The FCA (Financial Conduct Authority) is one of the world’s most effective regulators, ensuring that FXCM segregates all client funds from the operating capital of the company. UK traders are also offered negative balance protection, ensuring that retail clients will never lose more than their total equity.

On top of that, FXCM’s license under the Financial Conduct Authority (FCA) limits its leverage to 30:1 and is prohibited from offering bonuses or promotions to its traders.

What Are The Fees And The Commissions?

Trading Fees

FXCM offers a single commission-free Standard account, with spreads much wider than most brokers offer. The firm’s Active Trader program is geared toward traders with high trading volumes. Qualification as a professional trader is required to become an Active Trader. Additionally, accounts must meet a minimum combined notional volume of US$10 million on a monthly basis as well.

FXCM does not make public the average spread or its bid/asked spreads for individual currency pairs, which is not customary for the industry.

Swap Fees

Another important cost to consider is the margin interest rate charged on positions held overnight. Forex brokers charge interest when you hold positions overnight. The interest is calculated by the interest rates of the currencies you hold. The fee, unfortunately, is not published by FXCM on its website.

In the review of FXCM’s trading costs and swap fees, it was found that they are higher than those at some other brokerages.

Non-Trading Fees

FXCM does not charge deposit or account fees, but high withdrawal fees are charged for certain payment methods, and an inactivity fee is charged after a period of inactivity. Bank wire transfers incur a 25 USD withdrawal fee. After 12 months of inactivity, an inactivity fee of 50 USD is charged on the account balance. The account will be closed when the account balance becomes zero.

What type of accounts do they offer?

FXCM offers a single live-account commission-free account to conduct Forex or CFD trades. However, higher minimum deposits will grant traders access to the Active Trader Programme, which provides monthly rebates based on their trading volume. Traders who qualify for professional trader status are able to become an Active Trader and receive these bonuses.

Standard Account

- commission-free account

- $50 minimum deposit

- Forex leverage of up to 30:1

- CFD leverage up to 10:1

- option to become Professional Trader.

Professional Account

To achieve pro trader status, you must fulfill the following requirements:

- The trader has executed 10 or more trades of a size significant enough to impact the market over the past four quarters.

- The trader has a portfolio of assets exceeding 500,000 EUR

- The trader must have at least one year of experience in a professional position related to the product being traded.

Professional traders can access leverage of up to 400:1 on major currency pairs, and 200:1 on other contracts for difference (CFDs). Traders at the Pro level receive tighter spreads based on their trading volume, but this is dependent upon discussion with the account manager. Professional traders do not have the same protection against negative balances that retail accounts have.

Active Trader

To qualify as an Active Trader, you must maintain a minimum account balance of 25,000 USD and a certain monthly trading volume. Active Trader customers who generate higher volumes of trades will achieve tighter spread prices, receive access to the Market Depth module on their Trading Station platform, and receive dedicated account management in exchange for a small fee on the total volume of trades closed.

Demo Account

FXCM offers free demo accounts for traders to practice on. There is a $5000 demo account that expires after 30 days of inactivity. Traders can also use the free demo to trade on FXCM’s platforms, including Ninja Trader, Trading Station, and MT4.

FXCM also offers accounts for Muslims, which avoid paying fixed-interest charges that are required by Islamic law.

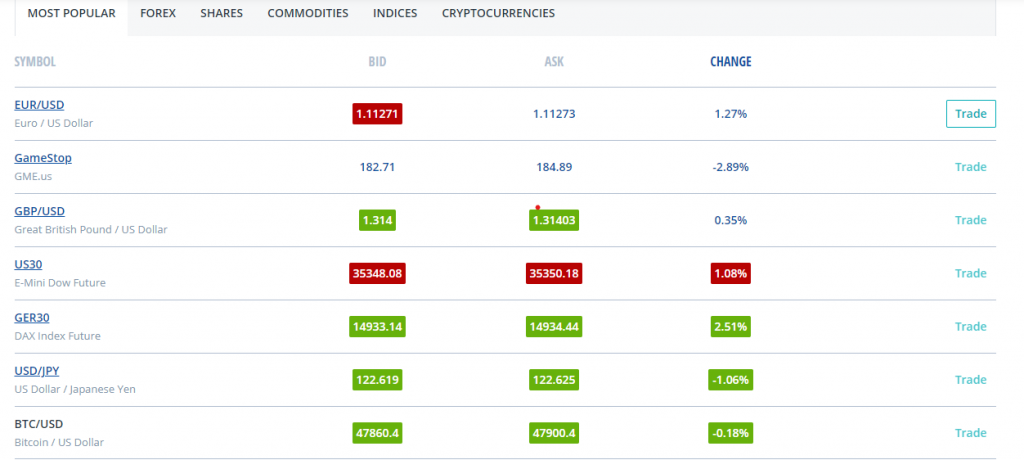

What Assets Can You Trade?

FXCM offers a variety of financial instruments, including Forex, share CFDs, commodities, cryptocurrencies, and indices.

- FOREX – FXCM provides 45 currency pairs to trade, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs – FXCM offers 219 share CFDs, a broad range of choices for trading the major US, UK, and European Exchanges.

- Indices – FXCM offers 15 different indices for trading. The most popular ones combine shares of some of the largest global companies.

- Commodities – FXCM offers trading in only 12 commodities, an average number when compared to other brokers. These include metals (gold, silver), energies (natural gas, oil), and agriculture (cotton, wheat).

What Are The Supported Trading Platforms?

FXCM supports various trading platforms, including MetaTrader 4 (preferred by forex traders worldwide), Trading Station, Ninja Trader, and others.

Trading Station

Trading Station offers many of the same features as Metatrader 4, such as EA integration, micro-lot trading, custom indicators, strategy optimization, strategy backtesting, and advanced charting. However, unlike MT4, Trading Station is easy to use and requires little setup time.

Trading Station’s features include:

- A wide range of charts

- Customized trading analytics

- A news calendar

- Education and research

MetaTrader 4

MT4 offers numerous advantages to traders, including support from the FXCM community and a rich variety of users. Setting up MT4 is more complex than with Trading Station, but if you choose to open multiple accounts at different brokers or switch brokers, MT4 is probably the better choice.

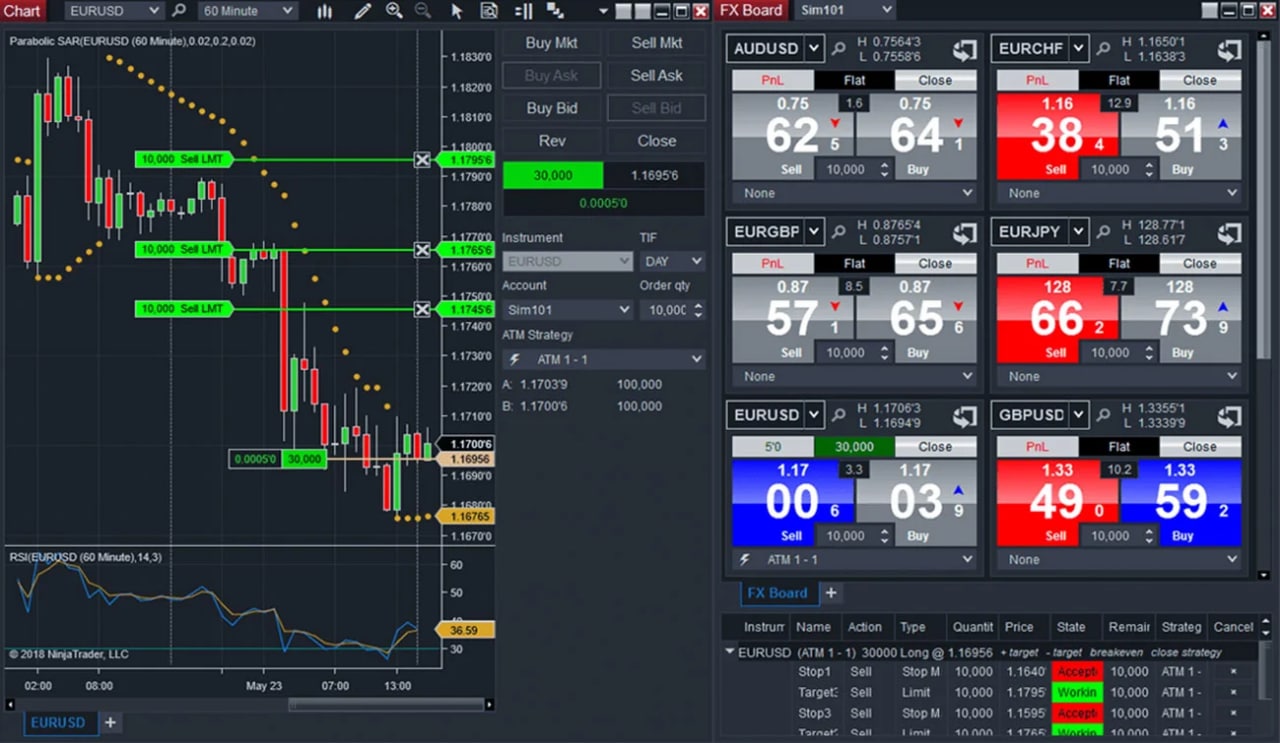

Ninja Trader

Ninja Trader is a platform used by experienced traders and it offers a clean interface compared to many other more advanced software packages. It is popular for its auto trading function. Advanced charting and analytics, along with fully customizable trade management strategies and auto-triggered profit target and stop-loss orders, are all at a trader’s fingertips with the platform.

Specialty Platforms

FXCM offers a variety of platforms for experienced traders.

- StrategyQuant – A machine-learning automated trading platform.

- QuantConnect – An algorithmic trading platform with API integration.

- NeuroShell Trader – A technical trading platform for building custom strategies for manual and automated trading.

- MotiveWave – A platform for technical traders with advanced tools.

- SeerTrading – An algorithmic trading platform with strong back-testing capabilities

- AgenaTrader – A powerful platform for professional traders.

- Sierra Chart – A professional platform with numerous 3rd party tool connections.

Mobile Platforms

Trading Station Mobile App

The Trading Station Mobile app allows trades to be placed and managed on the go through its simple, well-designed, and intuitive interface that makes it easy to open and close trades, view charts, and various technical analysis data.

MetaTrader 4 Mobile App

The Metatrader 4 mobile application has some limitations to functionality when compared to the desktop trading platform, including the removal of some time frames and fewer charting options. However, traders can still close and modify existing orders, calculate profit and loss, and trade on the charts.

What Sets FXCM Apart From Other Brokers?

FXCM offers a wide array of algorithmic trading tools and premium signals, a technical analyzer, trading analytics, and social trading via Zulutrade. The company also provides apps, VPS hosting, and API tools to allow its clients to build custom applications for algorithmic trading.

FXCM Apps

The FXCM Apps contain a variety of expert advisors, trading systems, and charting tools, with some available as free downloads. The FXCM app store offers add-ons for all supported platforms and is divided into several sections:

- Standalone Apps

- MT4 Expert Advisors and Automated Strategies

- Scripts and Add-ons

- Indicators

API Trading

The API toolset provides users with a set of documentation and code that can be used to build automated trading applications. FXCM offers four free APIs, each set to communicate with the trading server via a different communications protocol: REST, FIX, Java, and ForexConnect.

VPS Hosting

Virtual private server hosting provides traders with a non-connected virtual machine to run automated algorithmic strategies, including expert advisors 24 hours a day, 7 days a week. Virtual private server hosting has the advantage of never suffering connectivity issues and has extremely low latency due to its proximity to major international currency exchanges.

Trading View

Trading View is free to all clients who establish a live account with FXCM. It is best suited for serious traders who need high-quality research and screening tools. Additional features include:

- Synchronized layout for multiple charts

- 50+ intelligent charting tools

- More than 100,000 custom user-built indicators and scripts

FXCM Plus

Traders can also access FXCM Plus, a platform equipped with trading tools and indicators to improve how you trade.

- Trading Signals – These real-time, easy-to-follow trading signals can help you decide when to buy, when to sell, and where to set your stops and limits.

- Technical Analyzer – Identify important support and resistance levels on a chart (three, in particular), stay informed of indicators such as moving averages, MACD, and RSI and note their crossovers with the price action, and view significant candlestick patterns.

- Trading Analytics – Trading Analytics is a powerful tool designed to help you analyze your trading performance. Trading Analytics uses simple visualizations that enable you to identify mistakes in your trading, learn from your best trading habits, and improve your overall performance.

ZuluTrade

Zulutrade is a social trading platform that enables clients to access trades made by top traders. Clients can follow a trader’s portfolio and trade at the broker’s competitive spreads. Zulutrade pays 25% of the profits it earns from the trader’s successful returns to the trader, who may trade shares, forex, CFDs, and cryptocurrencies. Zulutrade also offers algorithmic trading and a dedicated brokerage desk to help traders succeed.

Does FXCM Offer Education And Free Research Solutions?

FXCM’s educational resources cover a variety of topics, such as trading guides, video tutorials, and a section on the traits of successful traders.

- New to Forex – This is a detailed and informative breakdown of how Forex trading works, with an overview of the various aspects to be aware of when trading. Quotes, Pips, Spread, Leverage, and Margins are covered in detail.

- Traits of Successful Traders – This list of best practices is essential reading for new traders. It explains the importance of a Stop Loss, the effective use of Leverage, and Trading Hours.

- Webinars – Here you can watch live and on-demand webinars on diverse topics, including Learn NinjaTrader, Algo Trading, Using Fibonacci’s in Your Trading and Automated Trading.

- Video Library – This video library contains a full range of FXCM videos, including important topics such as Deposits and Withdrawals, Order Types, and the Accounts Window. Some of the more useful videos are Trading from the Charts, Complex OCO Orders, Low-Volatility Trading, and Price Action. It is not necessary to be an FXCM customer to access this video library.

How efficient is Customer Support?

Support is available 24 hours a day, five days a week via live chat, phone, email and drop-in. Support is available in 19 languages and phone support is free for residents of 42 countries. The live chat and phone support are responsive, and the online help desk is well-informed and provides extra reading material when necessary.

How To Sign Up For A FXCM Trading Account?

FXCM offers individual, joint, and corporate accounts, but the focus of this article is on opening a personal account.

- Please click on the “Open Account” button on the home page.

- Traders must select their country of residence and the trading platform upon registering.

- FXCM directs traders to its secure server to complete the online application process. This involves filling in one’s name, email address, and selecting their preferred base currency. The trader must also fill in contact information and employment history, as well as financial status.

- A further step requires you to create a password and to agree to FXCM’s terms of service.

- Finally, traders are required to upload documents to verify their identity and residency. Traders can upload a copy of their ID/passport for verifying their identity; they can also upload a bank statement/utility bill verifying their residency.

Deposits And Withdrawals

FXCM follows all Anti-Money Laundering rules and regulations, ensuring that all withdrawals are returned to the deposit source.

UK residents can deposit and withdraw funds at FXCM by credit/debit card, Skrill, Neteller, or EFT/Bank Wire Transfer. There is no administration fee for either deposits or withdrawals via credit/debit card, but wire transfers incur a fee of 25 USD.

Bank transfers can take at least several business days to land in a trading account, while credit card/debit card and e-wallet transfers are instant. Withdrawals by bank transfer can take three to five days to process. Credit/debit card and e-wallet withdrawals are processed within 24 hours.

Is FXCM The Right Broker For You?

FXCM is a highly-regulated global Forex broker. All trading platforms support algorithmic trading, and FXCM provides four free APIs to developers on top of a wide selection of third-party plugins. The research section offers a tremendous asset to all traders and warrants an account opening to retrieve free access to it. Education is also taken very seriously with daily webinars and an excellent selection of very well-written content.

THE NEXT GENERATION OF TRADING TOOLS

- Ninja Trader - Advanced charting and analytics

- MetaTrader 4/5 – The world’s most popular trading platforms.

- API Trading - different communications protocol: REST, FIX, Java, and ForexConnect

- Trading View - more than 100,000 custom user-built indicators and scri

- VPS - never suffering connectivity issues and extremely low latency

Pros

- Highly regulated

- Great platform array

- Innovative trading tools and resources

- An excellent education

Cons

- Limited-access demo account

- Limited selection of assets

FXCM - Best Zero Commision Broker Award