Forex Trading Terms Explained

Place/Modify/delete Stop Loss & Take Profit Orders

In Forex Trading Terms can be find in different types or names.

Stop Loss – a pending order to close a position that is moving against you should the market price reach a predefined level.

Take Profit – a pending order to close a position that is moving in your favour should the market price reach a predefined level.

If you place these types of orders in Forex Trading you do not have to sit in front of your computer and wait for the outcome.

Take Profit and Stop Loss orders will be executed automatically as soon as the price reaches the order level.

You can place Stop Loss and Take Profit at the time of making a deal by filling in the “Stop Loss” and “Take Profit” fields in the “Order” window: In order to delete Stop Loss or Take profit orders specify its level as equal to zero.

What are PIPS?

One pip is the smallest unit of price change. It stands for ‘percentage in point’. Because most currency pairs are quoted with four decimal points, one pip usually equals 0.0001.

A pip is usually the last decimal place of a price quote.

Most pairs go out to 4 decimal places, but there are some exceptions like Japanese Yen pairs (they go out to two decimal places).

For example, for EUR/USD, it is 0.0001, and for USD/JPY, it is 0.01.

Let’s look at a EUR/USD example. If the price moves from 1.2880 to 1.2900, it has gone up by 20 pips. If it goes from 1.2880 down to 1.2820, it’s gone down by 60 pips.

Pips provide an easy way to calculate the profit or loss (also known as the P&L) on a trade.

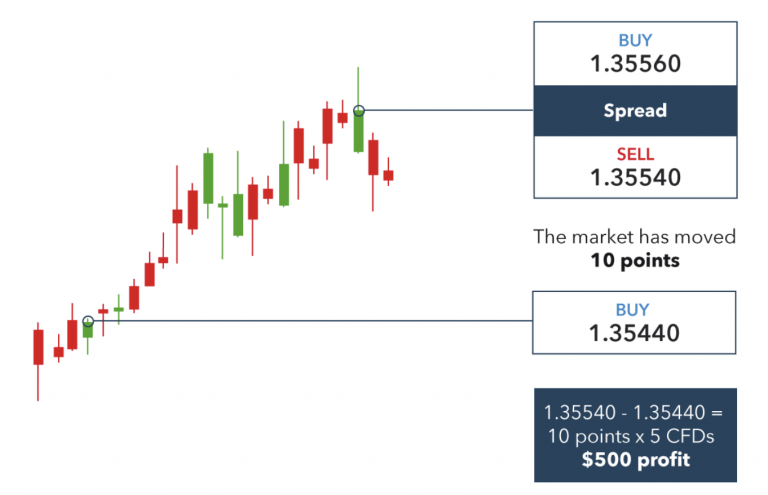

"Spread" in Forex Trading

The spread is the difference between the bid price and the asking price.

The bid price is the rate at which you can sell a currency pair and the asking price is the rate at which you can buy a currency pair (EUR/USD).

Whenever you try to trade any currency pair, you will notice that there are two prices shown.

The spread is essentially the cost of your trading.

You may come across brokers advertising low spreads but be sure to check what other commissions and costs they may be charging you.

What is "Lot" in Forex Trading

In Forex Trading is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell.

A lot is a unit to measure the amount of the deal. The value of your trade always corresponds to an integer number of lots (lot size * the number of lots).

Trading with the proper position or lot size on each trade is key to successful forex trading.

The position size refers to how many lots (micro, mini or standard) you take on a particular trade.

The standard size for a lot is 100,000 units of the base currency in forex trade, and now we have mini, micro and nano lot sizes that are 10,000, 1,000 and 100 units respectively.

What is "Long" in A Forex Trade?

Whenever you purchase (buy) a currency pair, it is called going long.

When a currency pair is long, the first currency is purchased (indicating, you are bullish) while the second is sold short (indicating, you are bearish).

For example, if you are purchasing a EUR/USD currency pair, you expect that the price of the Euro will go high and the price of USD will go down.

You Can Start Auto-Copy With Evolution FX for FREE!

What is "Short" in A Forex Trade?

When you go short on Forex, the first currency is sold while the second currency is bought.

To go short on a currency means you sell it hoping that its prices will decline in future.

In a Forex trade, whether you are making “long” (buying a currency pair) or “short” (selling a currency pair) trades, you are always long on one currency and short on another.

Therefore, if you sell, or go short on USD/JPY, then you are long on JPY and short on USD.

It means you expect the prices of JPY (Japanese yen) will rise and the price of the USD (US dollar) will fall.