Is it because of the strenght of the US army? The Bretton Woods Agreement? Is it because of the OPEC agreements or because of the fact that all countries hold it in large amounts? We will found out below.

First, the US Army and Navy.

The prerequisites for a reserve currency are less about economic might than it is about military might. The fact that the United States has both is why most international investors feel safe exchanging goods and services via the US Dollar.

This wasn’t always the case. The British Pound was the reserve currency prior to the World Wars. The British Empire’s Pound was secured by an elaborate network of Imperial supply chains and backed by the might of the Royal Navy. This made the Pound an attractive currency to conduct international trade. It was almost guaranteed that if you did business through the British Pound, that your transactions would safely reach their foreign destination.

World War I and II changed everything. The Germans employed a U-Boat strategy that quite effectively sunk more British ships than they could manufacture. Combined with the amount of money the British Empire borrowed to win the wars, they were forced to essentially sell their rights as a reserve currency to those damned Yanks, in exchange for supplies (and eventually an alliance).

This handover of reserve currency status was solidified in the 1944 Bretton Woods agreement. Much less known about this agreement was the brutal disagreements occurring behind closed doors between the Americans and British. British Economist, John Maynard Keynes, and American Economist, Henry Morgenthau, had yelling matches about how to transition the postwar economic system. But the Americans had all the leverage in the negotiations, and they ultimately pushed their agenda forward.

This became known as the Bretton Woods system, which is the system we all live under today. It was the largest peaceful transfer of responsibility in human history. The British essentially gave the Americans the keys to their Empire.

The Bretton Woods system is built on 4 pillars:

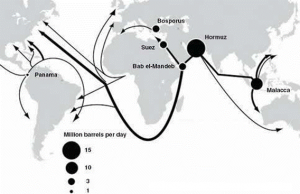

1. Choke points – The US Navy took responsibility to secure international trade via its Navy. They did this by placing Naval installations on maritime Choke points. Choke points are where oceans pass through narrow land bridges. It’s by no coincidence that all US foreign engagements since World War II have been about securing choke points. This is because controlling these choke points allows the US Navy to simply close off international trade access to a foreign rival, since all foreign trade is forced to pass through these supply routes. If a foreign power does not act in accordance to US interests, the US Navy can simply isolate their rival’s economy, and use this as leverage to force them to adjust their behavior accordingly.

2. Bribing up an alliance – The United States then offers absolute free access to international trade under the protection of the American Navy to those who act in the interests of US policy. This means that Denmark can trade its excess grain to Malaysia, for their excess rubber, and the US Navy will take the responsibility to make sure the trade between those two countries reaches their destination without harassment. And they do this for free… well kind of. All the US asks in exchange is that they make these transactions through the US Dollar reserve currency. Oh, and when the US is angry at someone, that means Denmark and Malaysia better be angry at them too.

3. Sanctions – Sanctions are when the United States is mad at someone, but doesn’t want to go to war with them. This is how the Soviet Union was dealt with, and a tactic used aggressively by the Trump administration. The US can choose to bribe all the other countries of the world to stop trading with a rival, under the threat they will cut their access off too. They do this by preventing all USD transactions to a specific country, and using their Navy to block direct supply routes to that nation. It effectively isolates the nation’s economy, making their economy extremely fragile. The Soviet Union only survived as long as they did because they had sufficient food, water and oil resources for self sustainability. Not everyone has that luxury. Which brings us to the last weapon the US has used, and was used, to bring down the Soviet Union.

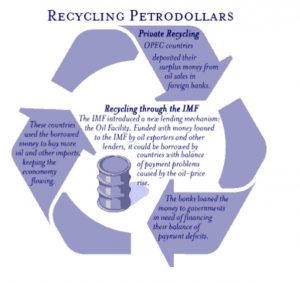

4. The PetroDollar – When China opened up its market to the US network in 1974, this allowed the United States to withdraw from Vietnam. The US then turned it’s focus to the Middle East, where massive oil fields were churning out enough energy for the entire global consumption. The US then established an agreement with the Saudis in the 1970s to exclusively trade their oil exclusively for US Dollars. In exchange, the United States promised to use its military to protect their interests. It was this agreement that allowed the US to drown the Soviet economy into submission (by flooding the global market with cheap Saudi oil). But the Catch 22, was that it was this agreement that has dragged the US to fighting a religious war they have no idea how to fight.

Global reserve currencies are historically rare. Throughout history, currency domination was usually established by regional powers, such as the Roman, Persian, and Han Empires. It wasn’t until the British that one national currency went global. And their currency domination lasted for only 2 centuries (essentially from the Seven Years War to the end of World War II). This forced the British throughout this 200 year period (1763 to 1945) to get involved in just about every global conflict, since every global conflict affected the stability of their currency network.

The British learned the hard way that while controlling the global currency was strategically expedient, it was ultimately unsustainable. They found themselves being forced to fight conflicts that weren’t directly in the interest of their own nation. In other words, they were forced to increasingly deploy their military when there wasn’t exactly a threat to their national security, but instead a threat to their currency stability. This was expensive, costly, and eventually dragged them into bankruptcy once Japan, Germany and Italy forced them to cash out on all their protection guarantees.

While it is doubtful a foreign currency, or Bitcoin for that matter, will ever challenge the supremacy of the US Dollar (at least in the near future), it is possible that the responsibility of maintaining a global currency could jeopardize the financial well-being of the United States. It is an exhausting responsibility, with global headaches and annoyances. It is why since 1945 we’ve had soldiers fighting in rice paddies in Indochina, cocaine fields in Colombia, oil compounds in the Islamic world and the jungles of sub-Saharan Africa.

In conclusion, the British might have conned the US in 1944 when they turned over the reserve currency.